Our Economy and Financial System

Economy

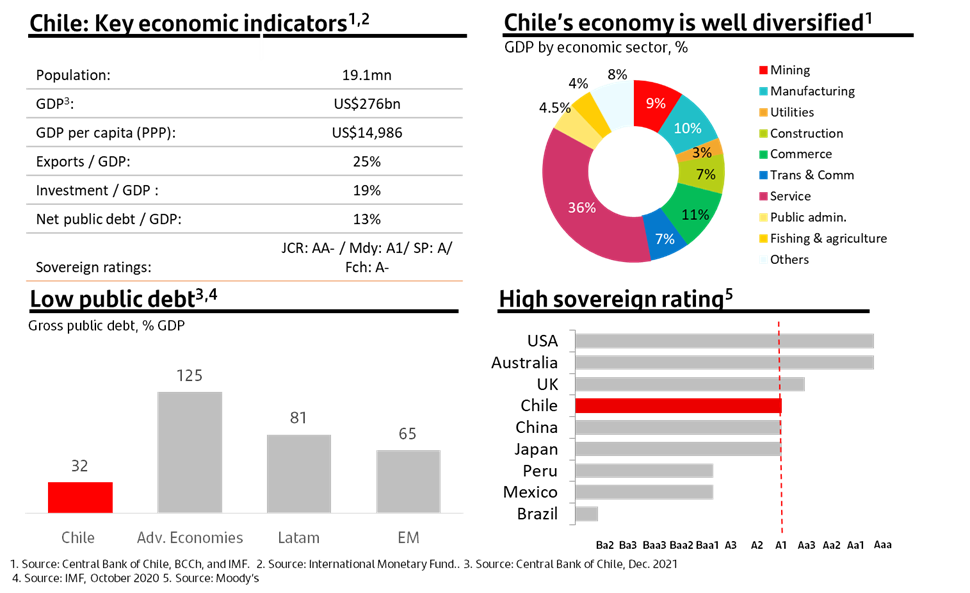

Chile’s economy is considered as South America’s most stable economy. GDP has become more diversified throughout the years.

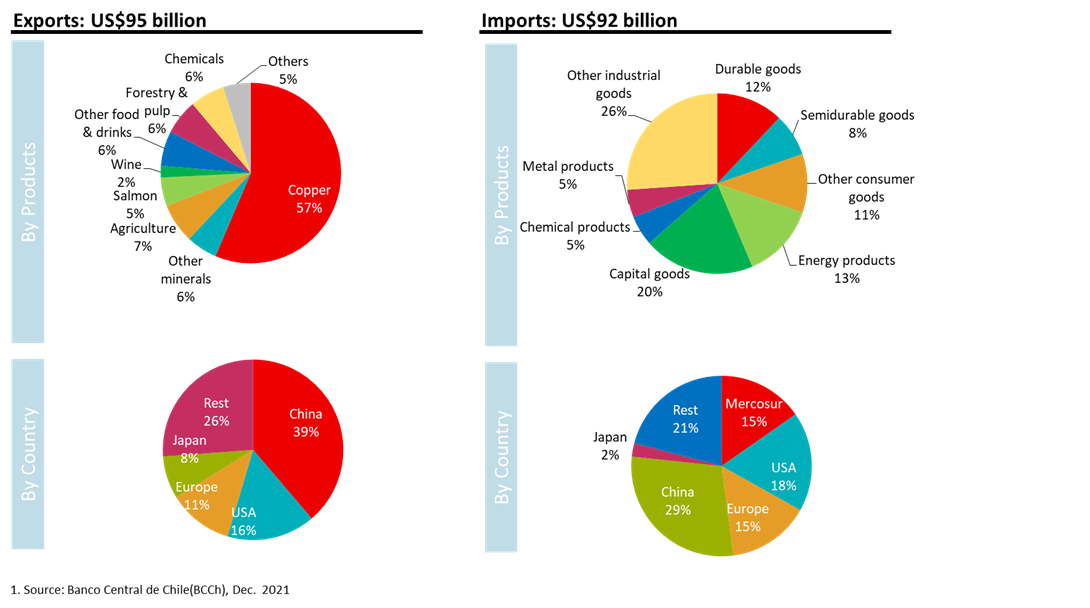

Chile is a productive country, with sectors such as mining, agriculture, fishing, forestry, and wine.

Chile sovereign rating

| Moody's | A1 (negative) |

| S&P | A (stable) |

| Fitch | A- (stable) |

| JCR | A+ (stable) |

Chile’s credit worthiness is high. During 2020, as a result of the social unrest in Chile and the COVID-19 pandemic, Standard and Poor’s Ratings Services (“S&P”) and Moody’s revised the Republic of Chile and the Bank’s credit ratings to a negative outlook. In March 2021, due to the ongoing pandemic and the consequent increase in government spending with a higher fiscal deficit, S&P downgraded the Chilean sovereign rating from A+ to A, changing the outlook to stable.

Our main local regulators

The Central Bank of Chile is autonomous in its decisions for the monetary policy rate. The Central Bank has a mandate to maintain inflation low and stable over time. The Central Bank targets a rate of 3% over a horizon of two years, with a range of ± 1%.

The Central Bank reserves the option to intervene in the market to manage the foreign exchange rate.

The Central Bank publishes every six months a Financial Stability Report to analyze developments in the macroeconomic and financial environment in Chile. They also publish a Monetary Policy Report on a quarterly basis to explain to the market the latest trends and decisions in terms of monetary policy rate. Additionally, they publish research on the economy done in-house as well as by third parties under the sponsorship of the Central Bank.

Please visit the regulator’s following webpage for more information: https://www.bcentral.cl

Before June 1, 2019, our bank regulator was called the SBIF, or Superintendencia de Bancos e Instituciones Financieras. This regulator was merged into the CMF, leaving one sole regulator for listed companies.

As of June 1, 2019, our bank regulator is the CMF, or Comisión de Mercado Financiero. Its mission is to promote social wellbeing, contributing to the development of the financial markets and preserving the trust in the system. The commission is made up of five members, designated in the following manner:

- President of the Comission designated by the President of the Republic for a term of four years.

- Four members designated by the President who must ratifed by the Senate for a term of six years, which can be reelected in pairs every three years.

The CMF publishes information on the banking system on a monthly basis. The information that can be found is extensive, ranging from detailed balance sheet and P&L reports to number of branches per region, to number of clients divided into various groups of interest, to types of products. Please visit the regulator’s following webpage: https://www.cmfchile.cl/portal/estadisticas/617/w3-propertyvalue-43347.html#estadisticas_bancos. We are happy to help in case you need to find any specific information.

Bank Competition

The Chilean financial services market consists of a variety of largely distinct sectors. The most important sector, commercial banking, includes a number of privately-owned banks and one public-sector bank, Banco del Estado de Chile (which operates within the same legal and regulatory framework as the private sector banks). The private-sector banks include local banks and a number of foreign-owned banks operating in Chile. The Chilean banking system is comprised of 18 banks, including one public-sector bank. The six largest banks accounted for 86.7% of all outstanding loans by Chilean financial institutions as of December 31, 2021 (excluding assets held abroad by Chilean banks). In July 2018, Scotiabank Chile acquired BBVA Chile, becoming the third largest bank in terms of loans in the Chilean market. Furthermore in the last quarter of 2018 BCI acquired the credit card financing business of Walmart Chile and the credit card of CMR Falabella was integrated into Banco Falabella. This represented an increase of total credit cards in the banking system of approximately 6%.

The Chilean banking system has experienced increased competition in recent years, largely due to consolidation in the industry and new legislation. We also face competition from non-bank and non-finance competitors, principally department stores, credit unions and cajas de compensación (private, non-profitable corporations whose aim is to administer social welfare benefits, including payroll loans, to their members) with respect to some of our credit products, such as credit cards, consumer loans and insurance brokerage. In addition, we face competition from non-bank finance competitors, such as leasing, factoring and automobile finance companies, with respect to credit products, and mutual funds, pension funds and insurance companies, with respect to savings products. Currently, banks continue to be the main suppliers of leasing, factoring and mutual funds, and the insurance sales business has grown rapidly.