Shareholders

Santander creates value for shareholders through a responsible management of risks, products and services, generating profits, and making their investment profitable and sustainable. In addition, equal treatment to all shareholders is guaranteed, independent of the ownership percentage in the business. The long-term relation is sustained over the base of providing all available information clearly, truthfully and in a timely manner.

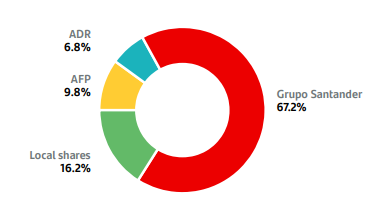

Santander Group holds a majority ownership stake of 67.2% in our company, while the remaining 32.8% constitutes the free float. Our company, Santander Chile, has dual listings for its stocks – they are traded on the Santiago Stock Exchange under the ticker "BSAN" and on the New York Stock Exchange (NYSE) in the form of American Depositary Shares (ADS) under the ticker "BSAC." Each ADS represents the right to receive 400 shares of our common stock. The Bank of New York Mellon serves as the Depositary for Santander-Chile's ADS Program. Currently, there are 188,446,126,794 shares of our common stock outstanding.

| Total shares issued | 188,446,126,794 |

| Free float | 32.82% of issued shares |

| Local share ticker | BSAN |

| Local share listing venue | Santiago Exchange www.bolsadesantiago.com/en |

| ADR to share ratio | 1 ADR = 400 shares |

| ADR listing venue | NYSE www.nyse.com |

| ADR ticker | BSAC |

| Depositary | BNY Mellon www.bnymellon.com |

| Postal Address | Bandera 140, 20th Floor Santiago, Chile |

Banco Santander Chile Shareholder Structure

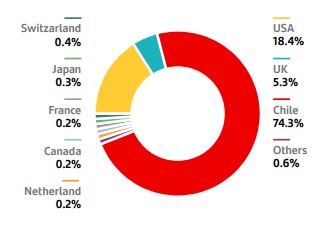

Geographical distribution of our minority shareholders

Top Minority Shareholders

Santander

| Holder | Shares Held | Shares Held | Country |

|---|---|---|---|

| A F P Habitat S A | 2.5% | 4,622,675,084 | Chile |

| A F P Cuprum S A | 2.1% | 3,944,837,334 | Chile |

| A F P Provida S A | 2.0% | 3,856,167,661 | Chile |

| A F P Capital S A | 1.9% | 3,497,867,603 | Chile |

| SCHRODERS PLC | 1.4% | 2,616,774,000 | UK |

| FRANKLIN RESOURCES | 1.1% | 2,011,758,000 | US |

| JP MORGAN CHASE & CO | 1.0% | 1,954,060,800 | US |

| T ROWE PRICE GROUP INC | 0.9% | 1,691,747,200 | US |

| A F P Modelo S A | 0.7% | 1,354,844,586 | Chile |

| Banchile Corredores de Bolsa S.A | 0.6% | 1,150,287,902 | Chile |

| ALLSPRING GLOBAL INVESTMENTS HLD | 0.6% | 1,137,288,400 | US |

| INCA INVESTMENTS LLC | 0.6% | 1,093,396,000 | US |

| A F P Planvital S A | 0.5% | 993,557,079 | Chile |

| BLACKROCK | 0.4% | 759,061,600 | US |

| Larrain Vial S.A.Corredora de Bolsa | 0.4% | 750,829,215 | Chile |

| Santander Corredores de Bolsa Limitada | 0.4% | 713,248,008 | Chile |

| VANGUARD GROUP | 0.4% | 688,014,000 | US |

| B.C.I.Corredor de Bolsa S.A. | 0.3% | 511,129,239 | Chile |

| Btg Pactual Chile S.A.Corredores de Bolsa | 0.2% | 441,861,061 | Chile |

| J P Morgan Securities Inc | 0.2% | 357,623,909 | Chile |